Big Moves Are Brewing…

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 GREAT BROKERAGE ACCOUNT: http://bit.ly/3mIUUfC

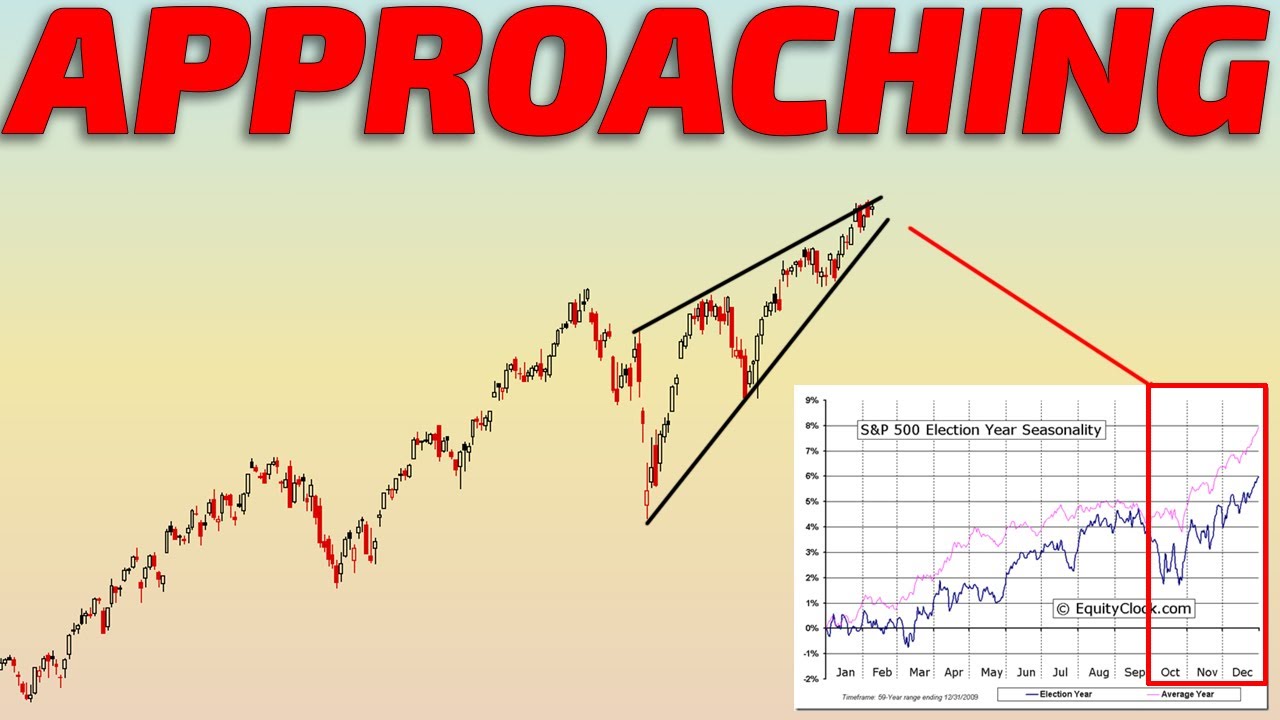

In this week’s recap, we dive deep into the stock market’s wild ride as the election countdown begins. The dollar is surging, 10-year yields are spiking, and the Fed continues to cut rates. Inflation is rising, consumer confidence is plummeting, yet retail sales remain strong, and job growth is accelerating. With the market sitting at all-time highs and sentiment at extreme greed, we explore whether a massive squeeze is brewing or if a pullback is on the horizon. Plus, we break down key market sectors, expected moves, and what it all means for your trading strategy. Buckle up—this is a must-watch episode!

TIMESTAMPS: 00:00

Market Performance: 00:51

Indices & ETFs: 02:33

Current Market Conditions: 10:33

Expected Moves: 12:34

Dollar Analysis: 15:45

Commodities: 16:25

Bonds & Yields: 19:33

Crypto: 21:24

__________________________________________________________________________________________

🔔 Subscribe now and never miss an update: https://www.youtube.com/c/figuringoutmoney?sub_confirmation=1

📧 For business inquiries or collaboration opportunities, please contact us at FiguringOutMoney@gmail.com

📈 Follow us on social media for more insights and updates:

🟢 Instagram: https://www.instagram.com/figuringoutmoney

🟢 Twitter: https://twitter.com/mikepsilva

______________________________________________________________________________________________

DISCLAIMER: I am not a professional investment advisor, nor do I claim to be. All my videos are for entertainment and educational purposes only. This is not trading advice. I am wrong all the time. Everything you watch on my channel is my opinion. Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting my channel 🙂

Interactive Brokers provides execution and clearing services to its customers. Influencer is not affiliated with, recommended by or an agent of Interactive Brokers. Interactive Brokers makes no representation and assumes no liability to the accuracy or completeness of the information

provided in this video. For more information regarding Interactive Brokers, please visit www.interactivebrokers.com. None of the information contained herein constitutes a recommendation, offer, or solicitation of

an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investment involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment

products/ services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website. Influencer is a customer of Interactive Brokers. Interactive Brokers and Influencer have entered into a cost-per-click agreement under which Interactive pays Influencer a fee for each click-through of the Interactive Brokers URL posted herein.

#Stockmarket #StockMarketAnalysis

25 comments

🟢 TRADE IDEAS & DISCORD: https://www.patreon.com/figuringoutmoney

🟢 GREAT BROKERAGE ACCOUNT: http://bit.ly/3mIUUfC

Furst🎉!!

I really appreciate your clear and simple breakdown on financial pitfalls! I lost so much money on stock market but now making around $10k to $15k every week trading different stock and cryptos.🎉🎉🎉

With copytrading, you could be sipping coffee on a balcony overlooking a bustling city skyline or lounging on a pristine beach, all while your investments work for you. Picture the freedom to pursue your passions, travel the world, and create lasting memories with your loved ones, all because you took the initiative to harness the power of copytrading and build the life you've always dreamed of

Dollar is pricing in a Trump win. His policies will result in a stronger dollar.

Although Israel said it won't attack Iran's nuclear or oil facilities, who knows!

Thanks for the video Mike. HAGW

The Oct Dip-buying Volume Soaring. Nikola.. NKLA.. Lillium LILM and Lucid.. LCID all with large Dips last week. VHAI rising 19 % week. Vocodia.. EVGO up 96 % mth . HYLN 23 % rise mth . SRFM up 61 % mth . Rivn.. Rivian..Xos Trucks 2 % Fri .Frey 3 % wk. Soun 13 % wk . SoundHound and Nvidia still rising. Thumbs Up video/ comments. Thanks.

interesting lots of bullish charts.

Awesome video!! Need crypto to start throwing fireworks though😅

This is your weekend Edition. I was watching Ancient Aliens.

I recently sold some of my long-term position and currently sitting on about 250k, do you think Nvidia is a good buy right now or I have I missed out on a crucial buy period, any good stock recommendation on great performing stocks will be appreciated.

How do most of you guys still make profit, even with the downturn of the economy and ever increasing life standards

Thank you!

I know nothing about trading/ Investing and I'm keen on getting started . What are some strategies to get started with ?

Looking for a pull back on spy next week before we hit new highs by the end of october.

Job creation surged because millions of illegal and WH approved legal immigrants are getting jobs at low wages. I was laid-off with 400 other FTE staff in the Video gaming industry. I know many more from Amazon, Microsoft, and other companies who have laid off workers or who are telling their staff the margins are dipping and they have made cuts in the company. No one is hiring in the Video game Industry and if they are hurting sure as hell is the entire market!

everything rally. everything US related rally.

its a noisy time in the markets, feel like we get some clarity after November meeting

I think you nailed the sentiment of traders trying to call the big crash 😮

ARKK and XBI need the fed to drop interest rates to near zero before they break out.

Seem to me with divergences everywhere, I would think it would be best to stay in cash.

People still think spy going 600+…idiots. no volume, vix up, 10year up, dxy green 13 out of 17 days. Spy and equities should already be down 10%, just with dxys move alone.

only up!!!!🚀🚀🚀🚀🚀

Very nice job covering the basics. I am sharing this not to brag but to show what’s possible. I’m retired and I have 2 separate portfolios. One is a long term growth dividend portfolio of stocks where i sell covered calls strategically and my 2nd portfolio is the Crypto trading strategy where its all about income. This year I am on pace to make $120K in realized options profits and around $730K in crypto profit… What is great is that my long-term portfolio is still up significantly as well. As such, it’s possible to generate excellent income but still have a total return perspective. …Amidst this, the insights of a knowledgeable guide like that of Sandy Barclays can be crucial. Her expertise in navigating the nuances of trading has been the key for Me understanding and making the most of these emerging financial trends.