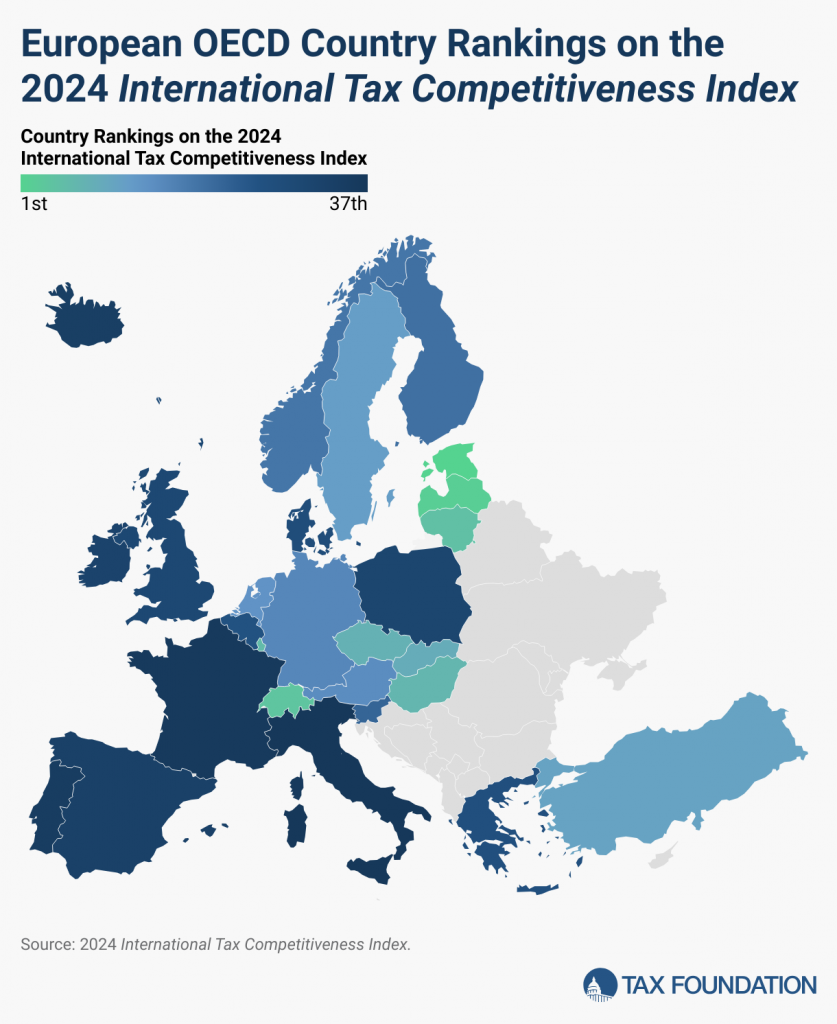

According to the annual report published by the Tax Foundation’s Center of Global Tax Policy, Greece ranks 27th overall out of 38 OECD countries on the 2024 International Tax Competitiveness Index.

The country remained in the same spot from last year’s list and is sandwiched between Belgium (26th) and Denmark (28th). For the 11th year in a row, Estonia ranked 1st on the Index.

The International Tax Competitiveness Index measures how well a country’s tax system promotes sustainable economic growth and investment. The report looks at dozens of variables in five categories: corporate income taxes, individual income taxes, consumption taxes, property taxes, and cross-border tax rules to offer important insight into each OECD country’s tax policy.

According to the report, Greece ranked 17th on the Corporate Tax Ranking, 9th on the Individual Tax ranking, 34th on the Consumption Taxes Ranking 27th on the Property Taxes Ranking and 21st on the Cross-Border Tax Rules Ranking.