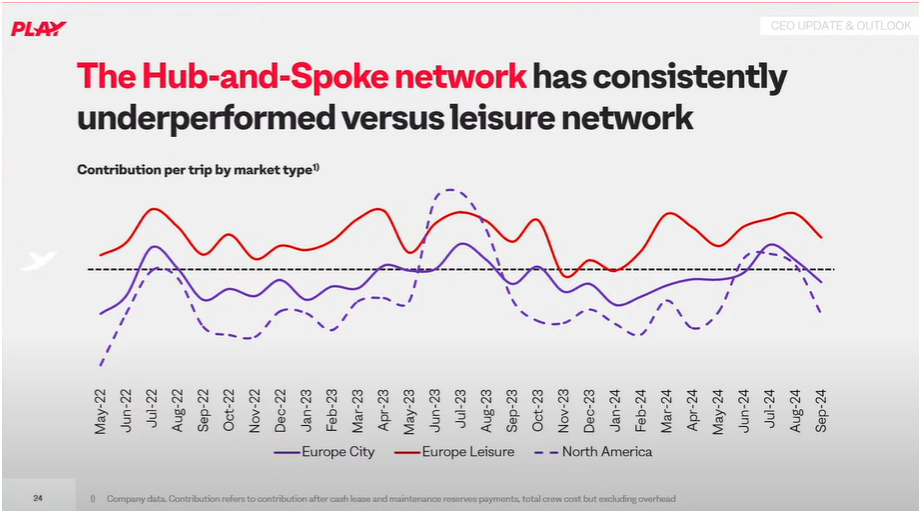

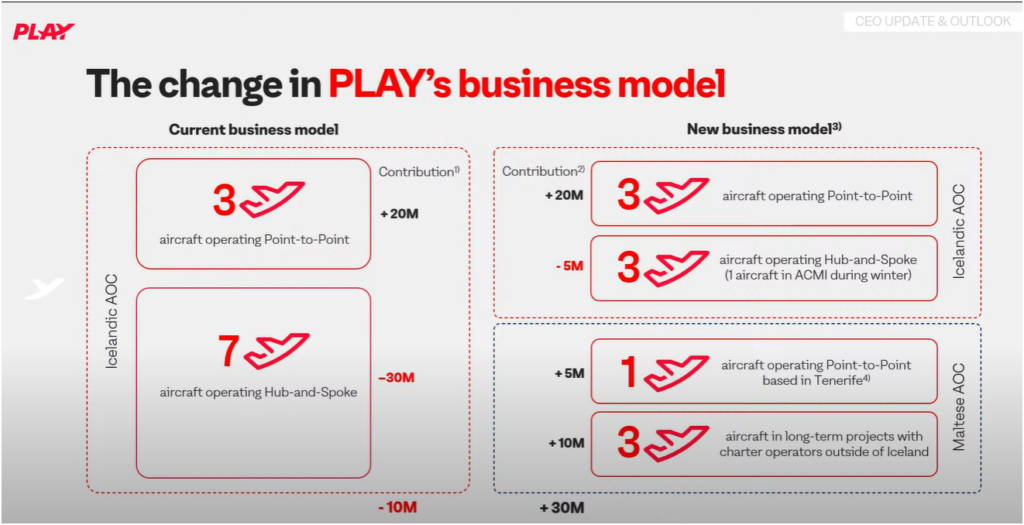

Iceland’s PLAY Airlines saw lower than expected revenue over the summer, citing excess capacity and depressed yields across the Atlantic. Now the carrier intends to pivot away from the hub-and-spoke model towards a point-to-point operation, focusing on flights from Iceland to Southern Europe, markets the carrier says have been profitable since their launch.

PLAY’s route map, with the purple markets expected to be trimmed in the year ahead, including a couple North America destinations disappearing

PLAY’s route map, with the purple markets expected to be trimmed in the year ahead, including a couple North America destinations disappearing

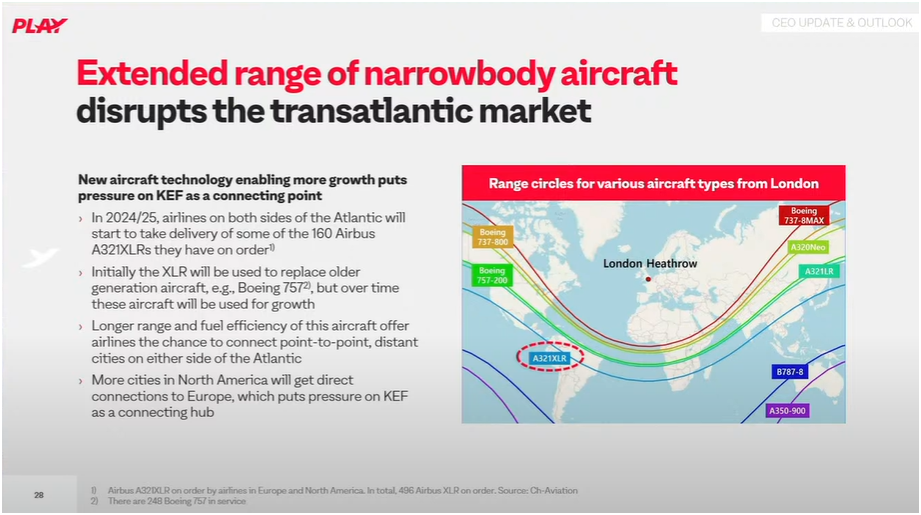

The carrier cites several reasons for the Transatlantic weakness (and why it is expected to continue), including:

Limited business travel, allowing leisure travelers to fly up front and leaving seats empty in the back

SAS bulking up North America service, making it easier for travelers to connect in Copenhagen rather than Keflavik

Introduction of the A321XLR, allowing airlines to overfly KEF with non-stop routes

Environmental regulations that will impact Iceland’s allowed emissions targets, reducing the competitive value of the hub

Will the A321XLR see more airlines overfly Keflavik on smaller routes? PLAY is betting yes as it trims its TATL offerings

Will the A321XLR see more airlines overfly Keflavik on smaller routes? PLAY is betting yes as it trims its TATL offerings

While these don’t entirely align with the reasoning from other airlines, the overall effect is similar: too many economy class seats crossing the North Atlantic depressed yields industry-wide. PLAY is not waiting around to see if the same will occur in 2025.

The carrier currently serves five North America destinations. That is expected to drop by Summer 2025 to just two or three operating daily. Frequencies will drop even further in the winter season. It also expects to cut several of its Northern Europe “City market” destinations, though specific numbers were not given.

Summer 2023 saw a spike in US-based TATL revenues for PLAY. That did not repeat in 2024.

Summer 2023 saw a spike in US-based TATL revenues for PLAY. That did not repeat in 2024.

Cutting costs with a Maltese AOC

Part of the PLAY plan includes establishing a new operating license (AOC) based in Malta to manage a subset of the fleet. Initially the company expects four aircraft will operate on this certificate. These planes will be based outside Iceland and will require “locally based crew for cost-savings purposes.” It is not uncommon for European airlines to set up new subsidiaries to undercut crew pay, though that is of little comfort to the crew faced with the new contract options.

PLAY’s new aircraft distribution plan

PLAY’s new aircraft distribution plan

One of the planes on the new Maltese operation will be based in Tenerife. It will primarily serve Iceland – Reykjavik and Akureyri are named as the main destinations. The other three will be based elsewhere in Europe catering to other local markets for other airlines with capacity constraints.

PLAY sees a valuable margin opportunity in the ACMI/charter market. It pays $40 million per year per aircraft while current market rates are $53-55 million. It expects to capture some of that spread, similar to airBaltic‘s approach where a significant portion of its fleet operates for other airlines. Among these opportunities, PLAY has a signed agreement with GlobalX to base one plane in Miami for the coming winter season.

Ultimately, the new model is a big bet on Iceland as a market, not a connection point. Whether Iceland can serve up enough demand to make that a success remains to be seen. The carrier expects the transition to occur over 12-18 months.

Did you enjoy the content? Or learn something useful? Or generally just think this is the type of story you’d like to see more of? Consider supporting the site through a donation (any amount helps). It helps keep me independent and avoiding the credit card schlock.