Owners of nuclear power plants had been riding high on hopes that they could sign lucrative contracts with tech companies to sell always-available power. A ruling from the Federal Energy Regulatory Commission won’t extinguish those prospects, but does throw a bit of cold water on them.

Late on Friday, the Federal Energy Regulatory Commission rejectedTalen Energy’s request to increase the amount of power that it could provide directly from its existing Susquehanna nuclear power plant to Amazon’s data center from 300 megawatts to 480 MW. That hamstrings Talen’s ability to step up the amount of power it sells directly to Amazon, whose co-located data center has a potential capacity of up to 960 MW.

By denying Talen’s revised agreement, FERC is emphasizing that it would “continue to prioritize grid reliability and existing stakeholders over rapid load growth and new power market entrants,” renewable energy-focused financial service firm Karbone wrote in a note to clients.

The ruling follows objections from utilities including Exelon and American Electric Power, who argued that the nuclear power plant would benefit from the grid’s transmission system without paying for it. FERC didn’t address the transmission cost aspect in its rejection, but simply said the parties didn’t meet the “high burden” to justify the change.

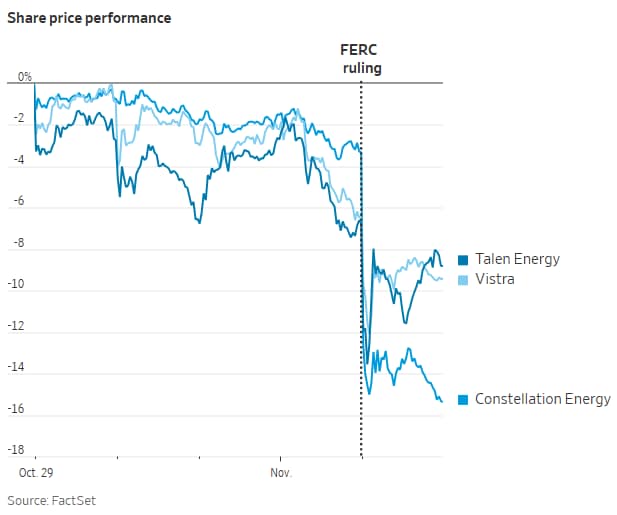

Talen Energy’s shares, after plunging as much as 8% Monday morning, recovered somewhat and were down about 2% by market close. Constellation Energy’s shares fell 12%, while Vistra’s stock shed 3%. Constellation has the biggest risk because so much of the stock’s gains in recent months were tied to hopes that it would sign contracts with tech companies for its existing nuclear power plants, according to a research note from Julien Dumoulin-Smith, equity analyst at Jefferies.

FERC’s decision isn’t a cause for panic, though. It could delay some power purchase agreement negotiations between nuclear power plant owners and data center developers, but it doesn’t shut the door on future contracts. For one, FERC hasn’t completely rejected deals directly connecting power plants to data centers, also known as behind-the-meter contracts. It might just need some time to deliberate on certain aspects, such as how much such power plants should pay for transmission services. Notably, FERC rejected the filing without prejudice, which means the companies could still submit a revised filing.

View Full Image

Graphic: WSJ

Even if the ruling holds, it would only limit companies’ ability to sign co-located, behind-the-meter contracts where the nuclear power is connected directly to the data center. Such contracts can command a premium because of how quickly the power can be connected, according to Steve Fleishman, equity analyst at Wolfe Research. Behind-the-meter contracts also come with lower transmission and other grid-related charges.

But there are other ways in which existing nuclear power plants can sell power to data centers. One example is the deal Constellation Energy reached with Microsoft to restart its Three Mile Island nuclear power plant. That deal is in front of the meter, which means Microsoft pays Constellation for power from the restarted nuclear power plant but doesn’t directly get electricity from that plant. Instead, the power plant delivers power to the grid and Microsoft gets to offset the additional power it will draw from the grid for its data centers with clean nuclear energy.

Such contracts don’t look so shabby either. Analysts at Morgan Stanley estimated that Constellation’s power purchase agreement with Microsoft was about $100 per megawatt-hour, about $20 lower than what a behind-the-meter deal would be worth but a big premium to the market rate of about $50/MWh for other in-front-of-the-meter contracts. One advantage of such contracts is that it allows the nuclear power plant to sell its full capacity rather than having to reserve half of the capacity as backup for refueling outages, according to industry analysts. The downside, of course, is that in-front-of-the-meter deals tend to take more time.

In an earnings call on Monday, Constellation Chief Executive Joseph Dominguez said the FERC ruling was “very narrow” and said co-location and competitive power markets remain “one of the best ways for the U.S. to build the large data centers that are necessary to lead on AI.” Talen Energy said in a press release that it will continue to pursue approval to increase the capacity connected to Amazon’s data center campus. Even if Talen can’t get that agreement approved, industry analysts think the company could come up with other ways to sell power to Amazon (for example, through a deal that resembles Microsoft’s).

FERC’s decision is no reason for panic selling of independent power producer stocks, but it is a reminder that speedy, round-the-clock power isn’t easy to come by for tech companies—especially when the grid is already so tight.

Write to Jinjoo Lee at jinjoo.lee@wsj.com