With polls showing a dead heat between the former president and the current vice president and control of the U.S. Congress also at stake, investors are wary of any unclear or contested result that could fuel volatility stemming from any lasting uncertainty about the political backdrop.

“This is the most significant election that I have seen in my career,” said Mike Mullaney, director of global markets research at Boston Partners, who has worked in investment management for over 40 years.

“It’s going to be very bifurcated, with certain things happening under Trump winning, and certain things happening under Harris winning,” Mullaney said.

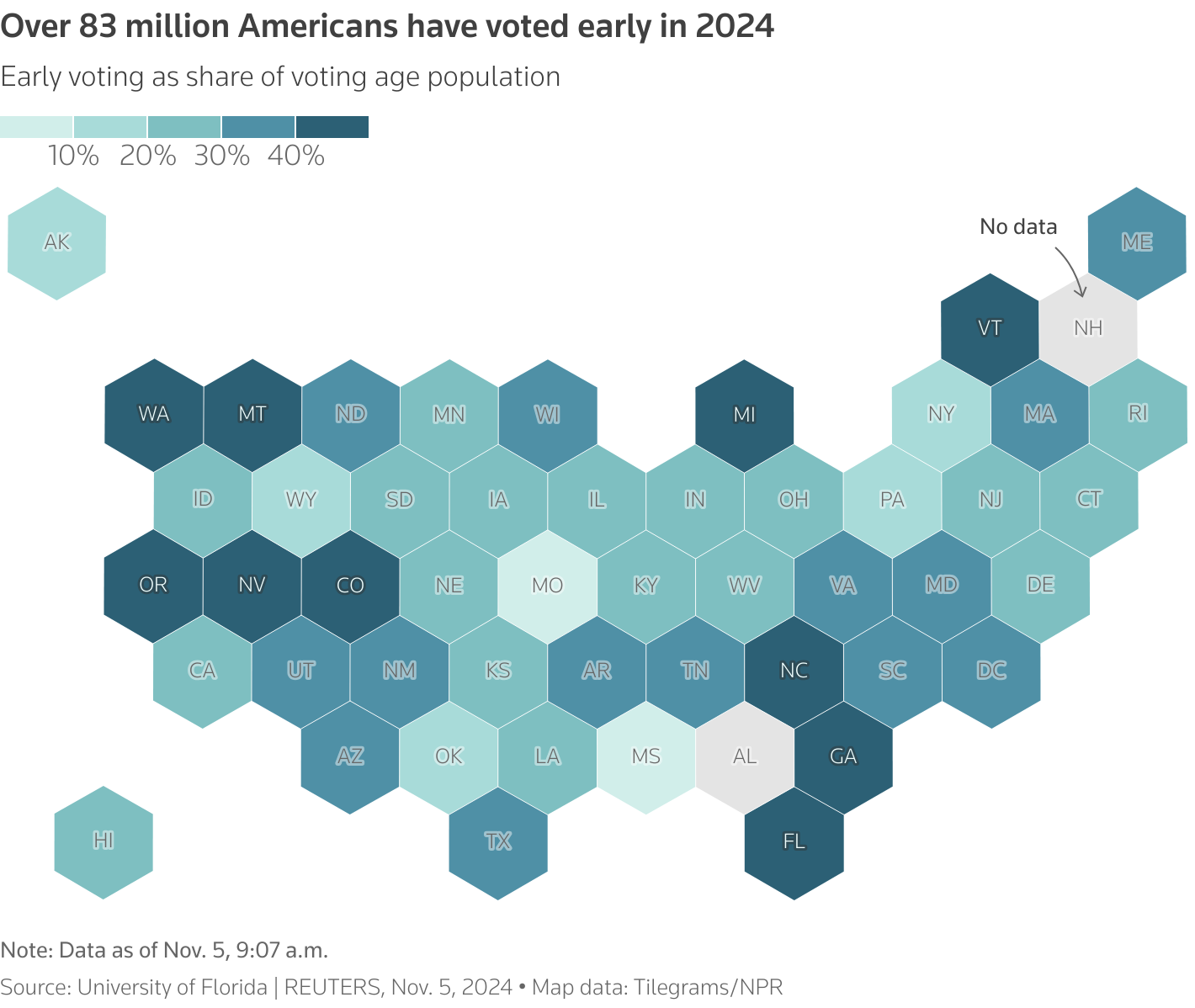

A cartogram of US map showing the early voting share of voting age population in the 2024 elections.

BETS SWAYING MARKETS

Bets on the election outcome have had a hand in swaying markets. Traders have cited Trump’s gains in polls and betting markets as a factor driving assets that could be influenced by his pledges to raise tariffs, cut taxes and decrease regulations.

Yields on Treasuries – which move inversely to bond prices – have also risen, as investors price in potentially higher inflation, another projected consequence of Trump’s policies.

Trump Media shares were up around 12% on Tuesday afternoon, while bitcoin was up some 4% as betting markets leaned more heavily in favor of Trump.

Several analysts said the so-called Trump trades were strengthening in the absence of new catalysts, and cautioned that results were still too close to call.

“People who back the former president tend to be quite enthusiastic,” said Steve Sosnick, market strategist at Interactive Brokers. “This is their last opportunity to express that enthusiasm in the market.”

“The market is getting pulled and pushed in different directions here as investors try to price in a lot of unknowns as it relates to the election,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management. “In the next week or so we will get certainty; either it reinforces this positioning or there is going to be a shakeout.”

‘BLUE WAVE’ SEEN UNLIKELY

Both Trump and Harris would likely need their respective parties to win control of Congress in order to alter tax rates. A so-called Blue Wave, where Harris prevails and Democrats gain control of both the House of Representatives and the Senate, is a result that most investors deem as unlikely, however.

“If Harris does win … she is now highly likely to face a Republican-controlled Senate, which would leave most of her fiscal plans dead in the water,” analysts at Capital Economics said in a note on Friday.

Historic data shows that stocks tend to perform well at the end of election years regardless of which party wins, as investors embrace clarity about the political situation.

While recent precedents for challenged elections are few, investors are mindful of 2000, when the race between George W. Bush and Al Gore was undecided for more than a month due to a vote recount in Florida. During that period, the S&P 500 slumped 5%, when sentiment was also weighed down by unease about technology shares and the broader economy.

An unclear election “is a big problem because that is what we had in 2000,” said Matt Maley, chief market strategist at Miller Tabak. “What is it going to do this time when you have so much going on in the geopolitical arena?”

Sign up here.

Reporting by Lewis Krauskopf in New York, additional reporting by Suzanne McGee, Michelle Conlin and Chibuike Oguh; Editing by Sandra Maler, Andrea Ricci, Lananh Nguyen and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles., opens new tab