Item 1 of 2 People vote for the 2024 U.S. presidential election, on Election Day at the Theater for the New City in Manhattan, New York City, U.S., November 5, 2024. REUTERS/Andrew Kelly

NEW YORK, Nov 5 (Reuters) – U.S. stocks advanced in a broad rally on Tuesday after data signaled a solid economy, but investors braced for volatile trading this week as voting began in an extremely tight U.S. presidential election.

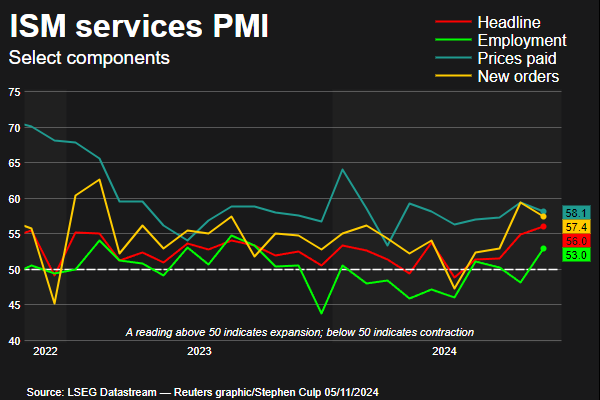

ISM services PMI

The former president’s odds improved on Tuesday in betting markets that many investors consider as election indicators.

“The market continues to try and price for what is the outcome of this election,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management in Seattle.

“It’s been so tight and even if we look at the price range we’ve been in, we’ve been in a tight price range, and so what’s really moving us is marginal positioning for one result or the other.”

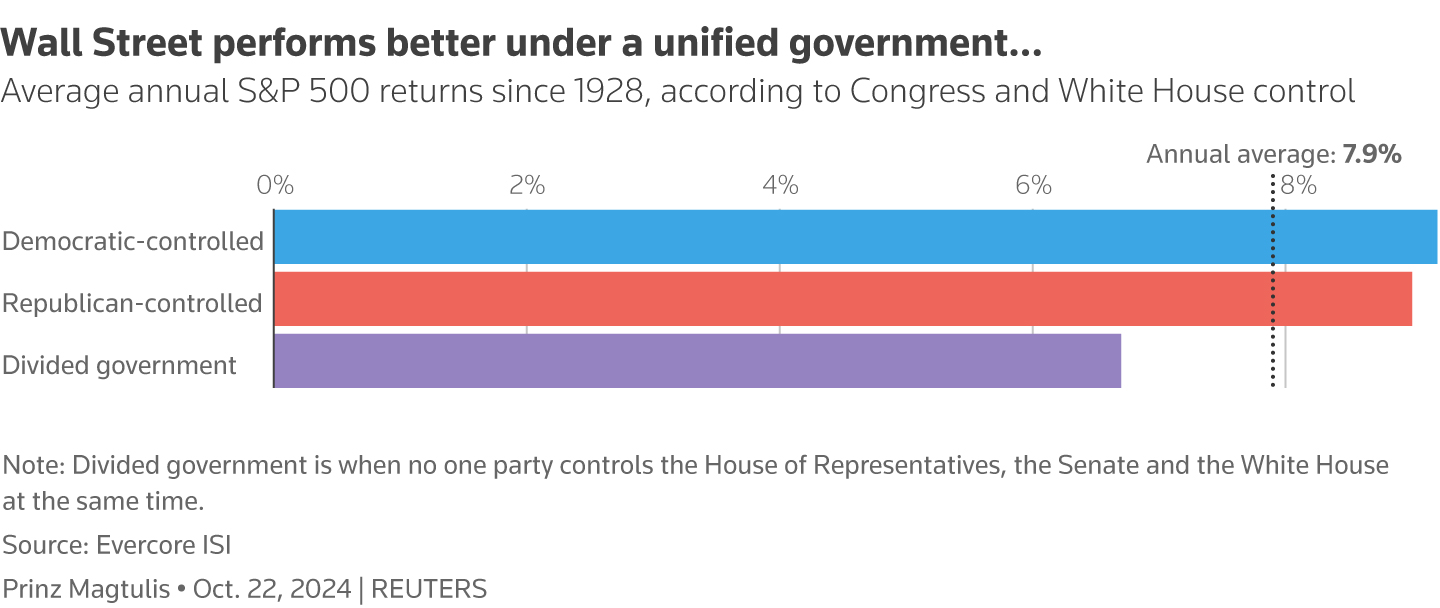

“Both the bond market and the equity market are looking at Congress as important as well,” he added. “Most base cases are for divided government, but this election is so close we could get any outcome, that’s the challenge.”

Volatility was more pronounced in government debt and currency markets. The benchmark 10-year U.S. Treasury note yield pared gains after a solid auction lifted it to a high of 4.366%.

Equity markets avoided the volatility of Monday on expectations of a soft landing for the economy, bolstered by corporate earnings, lower interest rates and a resilient labor market.

Reuters Graphics Bar chart with data from Evercore show the S&P 500 average annual returns according to White House and Congress party control since 1928.

Crypto stocks tracked bitcoin higher, with the cryptocurrency up roughly 4%, as Trump has positioned himself as friendly to the sector.

The Federal Reserve will announce its latest policy statement on Thursday. Markets have almost completely priced in a 25-basis point interest rate cut, but the outlook for the path of future easing is less certain given the economic strength.

Advancing issues outnumbered decliners by a 3.31-to-1 ratio on the NYSE and by a 2.41-to-1 ratio on the Nasdaq.

The S&P 500 posted 23 new 52-week highs and seven new lows while the Nasdaq Composite recorded 92 new highs and 100 new lows.

Sign up here.

Reporting by Chuck Mikolajczak; Editing by Richard Chang

Our Standards: The Thomson Reuters Trust Principles., opens new tab