Over the last 7 days, the UK market has risen 1.1%, and over the past year, it is up by 12%, with earnings expected to grow by 14% per annum in the coming years. Though ‘penny stock’ might sound like a relic of past trading days, these smaller or newer companies can still present opportunities when they are built on solid financials. We’ve selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains, offering investors a chance to discover hidden value in quality companies.

Top 10 Penny Stocks In The United Kingdom

Name

Share Price

Market Cap

Financial Health Rating

ME Group International (LSE:MEGP)

£2.055

£796.84M

★★★★★★

Next 15 Group (AIM:NFG)

£4.245

£433.13M

★★★★☆☆

FRP Advisory Group (AIM:FRP)

£1.355

£324.93M

★★★★★★

Supreme (AIM:SUP)

£1.52

£181.33M

★★★★★★

Brickability Group (AIM:BRCK)

£0.605

£193.31M

★★★★★★

Stelrad Group (LSE:SRAD)

£1.505

£191.03M

★★★★★☆

Luceco (LSE:LUCE)

£1.638

£246.15M

★★★★★☆

Ultimate Products (LSE:ULTP)

£1.415

£120.45M

★★★★★★

Tristel (AIM:TSTL)

£3.725

£188.22M

★★★★★★

Integrated Diagnostics Holdings (LSE:IDHC)

$0.42

$265.67M

★★★★★★

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom with a market cap of £559.27 million.

Operations: The company’s revenue segment is comprised entirely of Recreational Activities, generating £224.03 million.

Market Cap: £559.27M

Hollywood Bowl Group, with a market cap of £559.27 million and revenues of £224.03 million, has demonstrated strong financial health by maintaining debt-free status and achieving high-quality earnings growth. Its Price-To-Earnings ratio of 15.9x suggests it is trading at good value compared to the UK market average, while its Return on Equity stands at a robust 23.3%. Despite stable weekly volatility, recent insider selling may raise concerns for potential investors. The upcoming leadership transition with Darren Shapland as Chair Designate brings seasoned expertise to the board amidst an unstable dividend track record and uncovered long-term liabilities.

LSE:BOWL Financial Position Analysis as at Oct 2024

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Breedon Group plc, with a market cap of £1.51 billion, operates in the quarrying, manufacture, and sale of construction materials and building products primarily in the United Kingdom, Republic of Ireland, and internationally.

Story continues

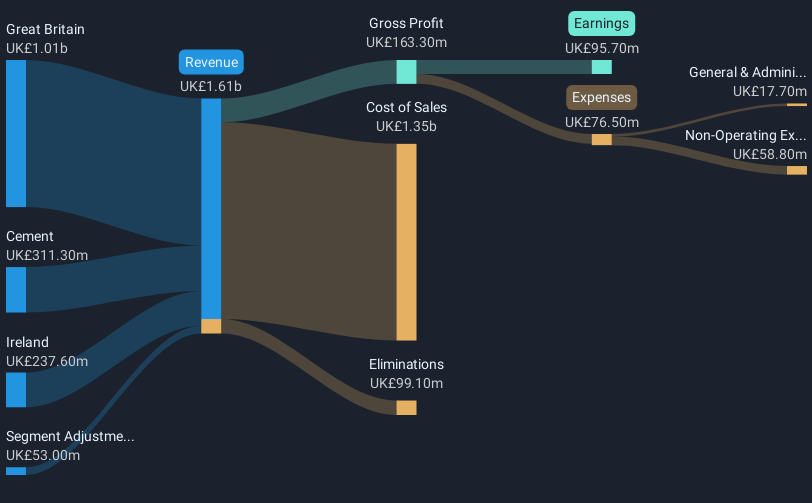

Operations: The company generates revenue through its Cement segment (£311.3 million), operations in Ireland (£237.6 million), and activities in Great Britain (£1.01 billion).

Market Cap: £1.51B

Breedon Group plc, with a market cap of £1.51 billion, operates across the UK and internationally in construction materials. Despite stable weekly volatility and satisfactory net debt to equity ratio (37.7%), the company faces challenges with negative earnings growth over the past year and declining profit margins from 7.3% to 6.3%. Its interest payments are well covered by EBIT (12.5x), yet short-term assets (£501.5M) do not cover long-term liabilities (£674.2M). Recent half-year results showed increased sales at £764.6 million but decreased net income (£34.1 million). Dividend coverage remains weak despite trading below estimated fair value by 46%.

LSE:BREE Revenue & Expenses Breakdown as at Oct 2024

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, with a market cap of £1.25 billion, operates an investment platform catering to UK financial advisers and their clients.

Operations: The company’s revenue is primarily generated from its investment administration services (£69 million), along with contributions from its insurance and life assurance business (£65 million) and adviser back-office technology (£4.8 million).

Market Cap: £1.25B

IntegraFin Holdings plc, with a market cap of £1.25 billion, demonstrates strong financial health and growth potential. The company has experienced significant earnings growth of 29.1% over the past year, surpassing the industry average. Its high net profit margin of 37.7% and return on equity of 27.4% indicate efficient management and profitability. IntegraFin’s debt-free status further enhances its financial stability, with short-term assets (£246.3M) comfortably covering both short-term (£28M) and long-term liabilities (£61.1M). Despite these strengths, investors should note recent significant insider selling and an unstable dividend track record when considering this stock.

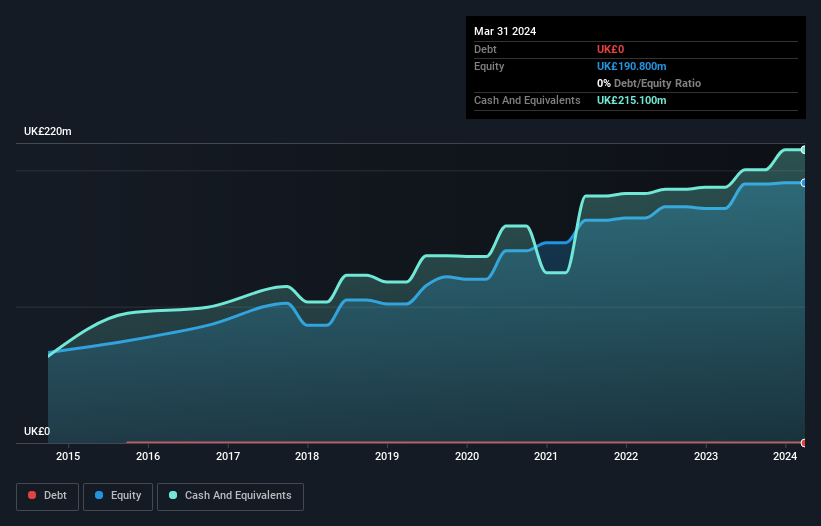

LSE:IHP Debt to Equity History and Analysis as at Oct 2024

Next Steps

Jump into our full catalog of 465 UK Penny Stocks here.

Have you diversified into these companies? Leverage the power of Simply Wall St’s portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BOWL LSE:BREE and LSE:IHP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com