With the U.S. Presidential Election just around the corner, the Fidelity Crypto Industry and Digital Payments ETF (FDIG) appears to be well-positioned to potentially benefit from the results.

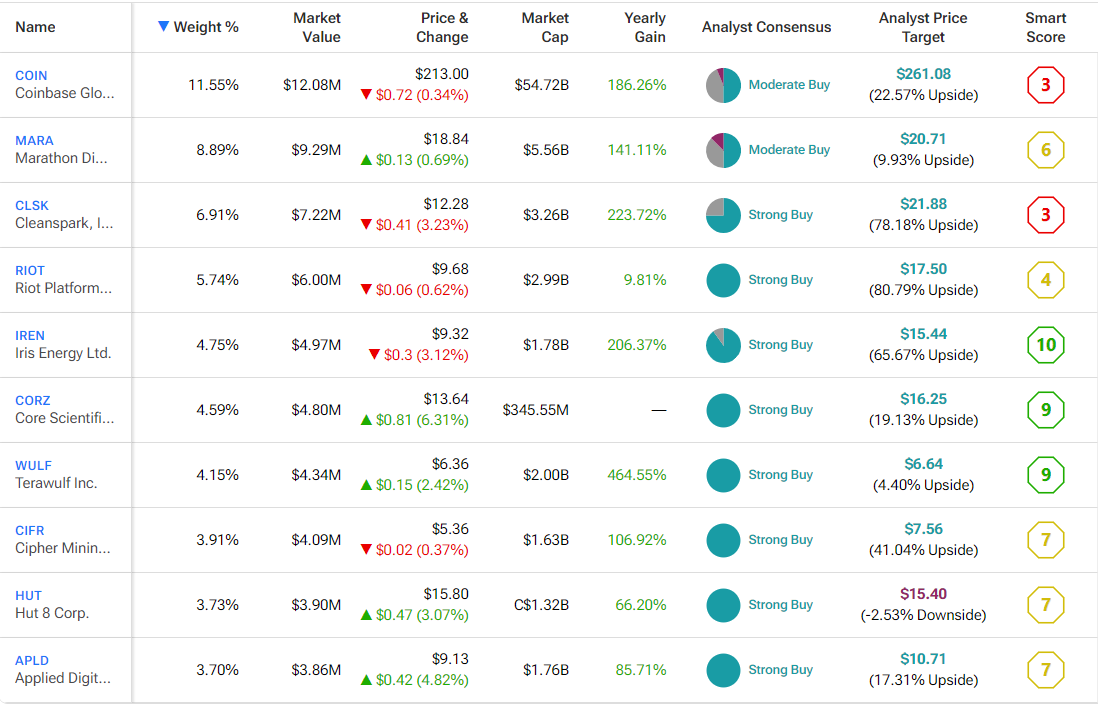

I’m bullish on FDIG and its portfolio of crypto-related stocks, which could enjoy significant tailwinds in the event of a Trump victory. While the fund is not particularly diversified, it offers plenty of exposure to the digital asset space, which could thrive in a Trump administration. FDIG also features a lower expense ratio than many of its peers. Additionally, sell-side analysts foresee potential upside of over 30% over the next 12 months, making FDIG a compelling investment opportunity.

Launched by Fidelity in 2022, FDIG is a relatively small ETF with $104.6 million in assets under management (AUM). According to fund sponsor Fidelity, FDIG’s objective is to “provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Crypto Industry and Digital Payments Index.”

The fund will typically invest at least 80% of its assets in this index. The index is composed of “companies engaged in activities related to cryptocurrency, related blockchain technology, and digital payments processing.”

Prediction market platform Polymarket now assigns a strong 64% probability that former President Donald Trump will win the U.S. Presidential Election in November. This strong probability bodes well for FDIG and other crypto-related stocks that it owns, as Trump has consistently and vocally supported Bitcoin (BTC-USD), cryptocurrency, and the crypto industry on the campaign trail. Trump has spoken at major crypto industry events and has met with top industry executives.

First and foremost, Trump’s Presidency would likely be good for Bitcoin. The former President has spoken about establishing a ‘strategic Bitcoin reserve’ to stockpile Bitcoin in a manner similar to the strategic petroleum reserve as a matter of national interest. Trump’s Presidency would also bode well for Bitcoin miners, as he says that he wants all remaining Bitcoin to be mined in the United States. A heavy 30% tax on Bitcoin miners proposed by the Biden administration would also be off the table.

Also, other players within the crypto industry would likely prosper from a friendlier and clearer regulatory framework as a result of a Trump presidency. Trump would seek a more collaborative approach with the industry and says he would form an advisory council of industry leaders. Trump has said, “The moment I am sworn in, the persecution stops and the weaponization against your industry ends.” Trump has also said he wants to ensure that the United States becomes the “crypto capital of the world.”

Story Continues