Economic activity in the Federal Reserve’s Fifth District (a multistate region including Virginia, North Carolina, South Carolina, West Virginia and Maryland) grew modestly from early September, according to the latest edition of the Fed’s Beige Book, released Wednesday.

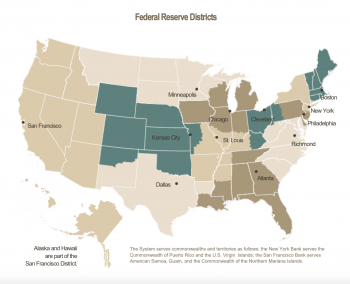

Published eight times per year, the Beige Book is based on anecdotal information about economic conditions gathered from the nation’s 12 Federal Reserve Banks. It is compiled from reports by bank and branch directors, as well as information gathered from business contacts, economists, market experts and other sources. The October release is an update from the Fed’s Sept. 4 report.

Here’s what the most recent Beige Book edition revealed about the direction the economy is taking:

Employment in the Fifth District increased slightly in the most recent reporting period. Although many businesses reported improvements in the labor pool and moderate wage growth, some firms reported continued challenges finding specific types of workers; they increased wages more and used outside help to attract those workers.

One example is a charter bus company that reported better driver availability but said it had to “dramatically” increase wages to attract skilled mechanics. A lighting manufacturer said it raised hourly wages by $2 for production workers.

Additionally, Hurricane Helene’s effects led to a spike in initial unemployment insurance claims in North Carolina in the first week of October.

Price growth in the region continued to ease slightly in recent weeks, according to the Fed. Prices grew at a “modest to moderate rate” year-over-year. The prices that manufacturing firms received grew modestly compared to the previous year, while service providers saw moderate annual price growth. Some consumer-facing businesses said they believed customers wouldn’t accept further price increases.

Manufacturing activity ranged from flat to slightly up for some producers. Some producers reported an increase in orders — a fuse panel manufacturer, for example, reported a backlog going into 2025 because of large recent orders. Nevertheless, some respondents reported delays on new orders because of uncertainty, like a textile manufacturer that reported it expected tepid demand as customers were being cautious ahead of elections.

Fifth District ports reported a slight increase in containerized cargo volumes while they allowed for additional trucking traffic to offload ships in advance of the anticipated International Longshoreman’s Association worker strike on Sept. 30. The strike lasted three days and was suspended until Jan. 15, 2025. The 45,000 union workers involved included 6,000 workers at Fifth District ports.

Port respondents said the three-day strike had little impact on operations because of its brevity. They also expected the resulting wage increases to affect future container rates.

Trucking demand remained flat, and companies expected it to stay muted going into winter. Trucking firms reported that profitability was down because freight spot rates fell.

Consumer spending in the region picked up modestly over the most recent reporting period. Retailers reported an increase in sales and shopper traffic. Some respondents said that revenues were up despite flat transaction volumes because prices were higher.

Hotel and tourism contacts said business travel increased, but leisure travel slowed. One hotel representative attributed the slowdown partly to the active hurricane season. Respondents in western North Carolina were still assessing Hurricane Helene’s damage and impacts, but most said they expected to feel the storm’s impacts for several months.

Fifth District residential real estate had a slight downtick in recent weeks, which many real estate agents attributed to a typical fall slowdown and the hold for rate cuts.

A Virginia agent said housing inventory was rising, particularly with fixer-uppers and less-than-ideal homes coming on the market. According to Virginia Realtors data, in September, Virginia had 19,764 active listings and 11,378 new listings, both year-over-year increases.

Contacts across the Fifth District also mentioned lawsuits and continued uncertainty related to the National Association of Realtors policy changes.

Commercial real estate activity leveled off in the past month, according to the Fed. Although vacancy continued to grow in lower-grade markets, vacancies decreased in prime A spaces. A residential and metal buildings construction company in Virginia said it had fewer potential customers and that clients were having more difficulty affording the company’s work.

Also, Hurricane Helene caused severe destruction of commercial and residential properties in western North Carolina and Virginia, but the extent of the damage isn’t yet clear, the Fed said.

Financial institutions saw a modest increase in loan demand, driven mainly by interest rate cuts. Commercial real estate and first mortgage refinancings were the main drivers of the increased demand. Deposit levels remained stable. Loan delinquency rates remained stable, although lenders reported a continued modest decline in borrowers’ credit quality.

Nonfinancial service providers continued to report little change in demand to the Fed, and their revenues remained stable. One law firm said they anticipated a modest increase in merger, acquisition and real estate deals because of decreasing interest rates. Some contacts reported they thought economic activity was constrained because clients were hesitant to make new investments or business decisions until uncertainty about the presidential election and international conflicts was resolved.

T