It’s no secret that Nvidia (NASDAQ: NVDA) is making a mint in the artificial intelligence (AI) market. Its AI accelerator chips are the pick of the litter for high-end AI-training systems, and those systems are in high demand these days.

Nvidia’s stock is a very direct bet on a long-running AI boom. It’s not necessarily a slam-dunk winner, and investors should keep a couple of big risks in mind before buying these shares. But there is a world where Nvidia comes up aces and continues to outperform the stock market.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

So let’s take a quick look at Nvidia’s investment risks and what it would take to keep the market-beating party going.

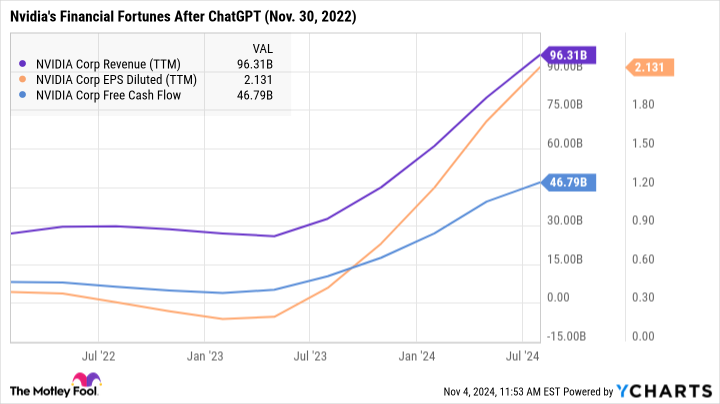

It’s true that Nvidia got the jump on the competition. OpenAI‘s first public version of ChatGPT was trained on more than 10,000 Nvidia V100 accelerators. Later versions of the same large language model (LLM) training setup will use many more units of newer, more powerful, and more expensive accelerator chips. Nvidia’s financial charts show a sharp inflection point (aka “hockey-stick” moment) when it started to fill orders inspired by the ChatGPT release:

NVDA Revenue (TTM) Chart

But there are actually many alternatives on the chip market. Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC) have their Instinct and Gaudi processors, respectively. Cloud computing giants such as Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Amazon (NASDAQ: AMZN) are ordering Nvidia chips by the truckload — but have also developed their own AI accelerators in an effort to cut costs and meet specific performance targets. Even OpenAI is working on a custom chip design in partnership with Broadcom (NASDAQ: AVGO).

Every chip design comes with a different balance of performance, price, power and cooling requirements, and unique features. Intel even brings its own manufacturing facilities to the game, dodging the potential bottleneck of every fabless designer jockeying for time on the usual manufacturing lines.

Nvidia is on top so far, but who’s to say what chip designer might win the next generation’s most lucrative design contracts? If the answer isn’t Nvidia, its investors could be in for a sharp price correction.

You see, Nvidia’s stock has skyrocketed in the ChatGPT era. The stock has gained 928% in two years and 216% in the last 52 weeks. With a $3.4 trillion market cap, Nvidia’s stock trades at the lofty valuation ratio of 74 times free cash flows or 36 times sales.

Story Continues